Canada Learning Bond

The Canada Learning Bond (CLB) is money that the Government adds to a Registered Education Savings Plan (RESP) for children from low-income families.

What is the Canada Learning Bond?

The Canada Learning Bond (CLB) is money that the Government adds to a Registered Education Savings Plan (RESP) for children from low-income families. This money helps to pay the costs of a child’s full- or part-time studies after high school at:

- Apprenticeship programs

- Trade schools

- Colleges

- Universities

No personal contributions to an RESP are required to receive the CLB.

- Money is retroactive (can be requested up to age 21)

- Interest income tax-free

- Eligibility thresholds do change

- Both parent and child must have identification (SIN Number)

- Parents taxes must be up to date in order to verify income and eligibility

How much a child could receive:

The Government of Canada contributes up to $2,000 to an RESP for an eligible child. This includes:

- $500 for the first year of eligibility

- $100 each year the child continues to be eligible

Eligibility:

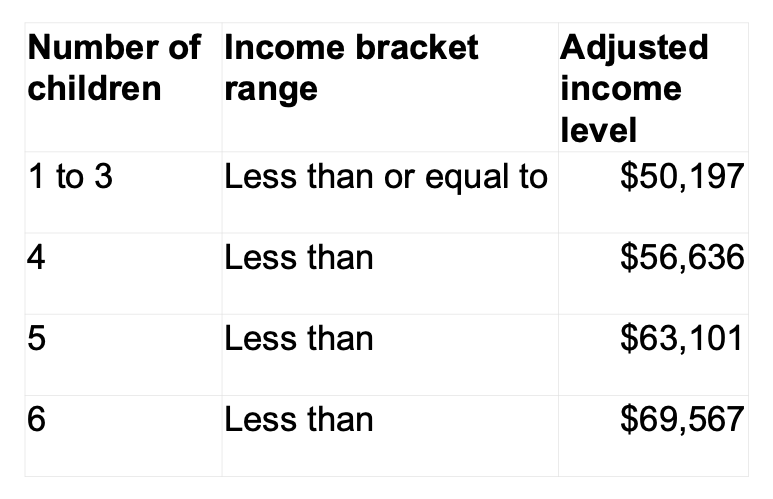

Eligibility for the CLB is based on the:

- number of qualified children in the family, and

- adjusted income of the primary caregiver, including the income of a cohabiting spouse or common-law partner

Adjusted Income is an individual's net income plus that of their spouse or common-law partner, where applicable;

- minus any Universal Child Care Benefit (UCCB)

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

RESPS

What are RESPs?

RESPs are savings plans that allow your contributions to grow tax free. On top of your own contributions, RESPs are eligible for government grants that can bolster savings. RESPs are set up for a beneficiary (such as a child or grandchild) and by a subscriber (whoever is contributing money to the plan, like a parent or grandparent).

Types of RESP’s

Individual 🙋

An individual plan can have only one beneficiary, who doesn't have to be related to the subscriber.

Family 🙋🙋🙋🙋

A family plan lets the subscriber name

more than one beneficiary, add a beneficiary or change the beneficiary at any time. Beneficiaries in a family plan

have to be related to the subscriber by blood or adoption.

QUESTIONS?

My Child is Ready to go to School - Now What?

- Only the subscriber can request funds from the account, and needs a beneficiary's proof of enrollment in a post-secondary program or institution to show it's for educational purposes.

- Subscribers have already paid taxes on this money, so it won't be taxed again. Money from grants and accumulated income (from interest, dividends or capital gains) is called an Education Assistance Payment (EAP) and goes to the student. This money will be taxed, but generally at a lower rate since students usually have little or no income.

What if my Child doesn't Attend Post Secondary?

- RESP can remain open until the beneficiary is 35 years old

- In an Individual Plan, the subscriber can name another beneficiary.

- In a Family Plan, you can direct any government grants and earned income to another sibling.

- You can also dissolve the RESP by withdrawing your investment. Government grants are returned to Government of Canada.

How Does the YWCA Help?

- One-on-One Appointments

- Open the RESP remotely through our partner WealthSimple or assist in setting up an appointment with the preferred Financial Institution

- We offer Subsidies for Identification Documents like Birth Certificate and SIN Number

- Assistance finding local tax clinics

Contact

stacey for more info or

sign up here for a one to one information/sign up meeting!

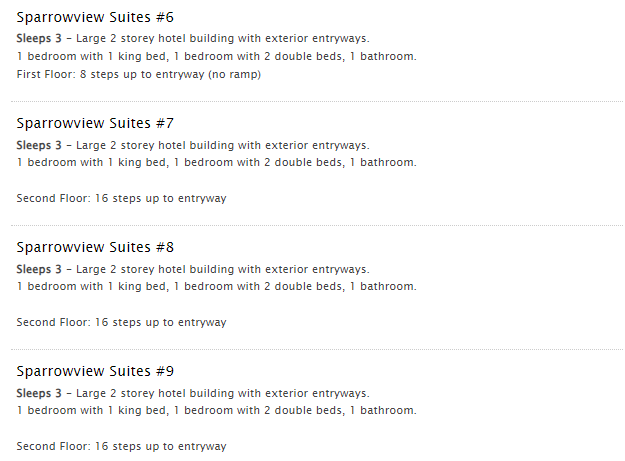

Please note that these accommodations are changing regularly and once individuals and MA's have confirmed, some spaces may open up but we know for sure only Sparrowview Suites are left. Thank you.

CONTACT US

All Rights Reserved | YWCA Muskoka

Website designed & developed by Client First Web Design & Graphics

Privacy Policy

Contact Us

Charitable #890754021RR0001